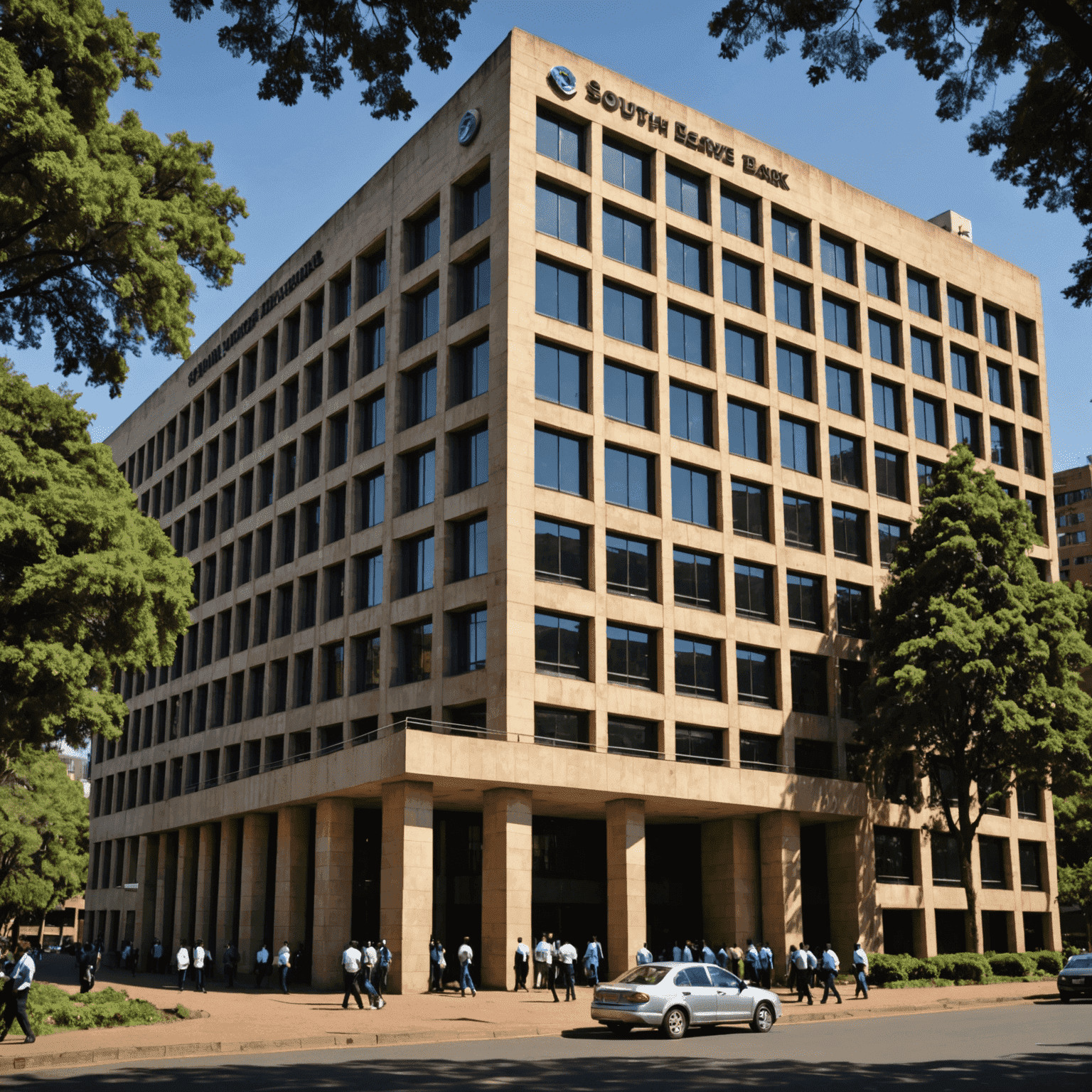

South African Reserve Bank Announces New Measures to Boost Economic Growth

In a bold move to stimulate South Africa's economy, the South African Reserve Bank (SARB) has unveiled a comprehensive package of financial measures aimed at boosting growth and fostering economic stability.

Key Highlights of the New Measures:

- Reduction in interest rates to stimulate borrowing and investment

- Introduction of targeted lending programs for small and medium enterprises

- Enhanced liquidity support for the banking sector

- New initiatives to promote financial inclusion and literacy

The Governor of the SARB, in a press conference held earlier today, emphasized the importance of these measures in addressing the current economic challenges faced by South Africa. "These initiatives are designed to provide a foundation for sustainable economic growth and to enhance the financial well-being of all South Africans," the Governor stated.

Impact on Personal Finance

For individual South Africans, these changes could have significant implications for personal financial management. The reduction in interest rates may lead to lower borrowing costs for mortgages, personal loans, and credit cards. However, it also means that savers might see reduced returns on their deposits.

Financial Literacy Tip

Now is an excellent time to review your personal budget and financial goals. Consider how these economic changes might affect your savings strategy and debt management plan.

Expert Analysis

Financial experts are cautiously optimistic about the new measures. Dr. Thabo Molefe, a leading economist at the University of Cape Town, commented, "While these initiatives show promise, their success will depend on effective implementation and the broader global economic context. It's crucial for South Africans to stay informed and adapt their financial strategies accordingly."

Looking Ahead

As these new economic measures take effect, it's more important than ever for South Africans to enhance their financial knowledge and skills. Understanding how these changes impact personal finances can help individuals make informed decisions about budgeting, saving, and investing.

Stay tuned to SkillBuild SA Finance for more updates and practical advice on navigating these economic changes and building your financial confidence.